Medicare Quality Payment Program

What is the Medicare Quality Payment Program?

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) developed the ground work for a new program known as the Quality Payment Program (QPP), under which clinicians have the opportunity to earn bonuses, or face penalties in the form of positive, neutral, or negative adjustments based on their performance in quality and cost measures. On Nov. 4, 2016, CMS finalized its policy implementing the QPP. The QPP shifts physician reimbursements from the traditional fee-for-service model to a value-based payment model. The CMS Innovation Center (CMMI) develops and tests new healthcare payment and service delivery models, and the QPP is one such model. The CMMI’s models are alternative payment models (APMs) which reward health care providers for delivering high-quality and cost-efficient care.

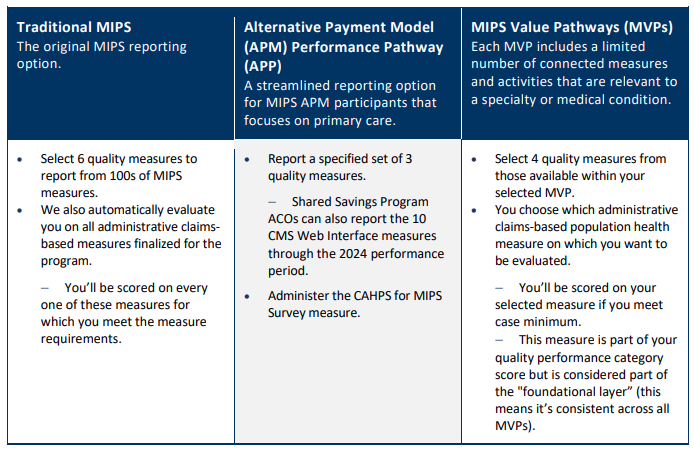

The QPP offers three main reimbursement/participation tracks for physicians under Medicare Part B, with an optional track starting 2023:

Track 1: The Merit-based Incentive Payment System (MIPS)

Track 2: Advanced Alternative Payment Models (APMs)

Track 3: MIPS Value Pathways (MVPs) - Optional track beginning the 2023 performance year

Review the MIPS Quick Start Guide found on the QPP website and the HCMS MIPS Step-By-Step Guide which includes information on how each category is scored, along with step-by-step details on how to report each MIPS category for the performance year (PY).

QPP Resources

- Latest QPP Final Rule QPP Overview (scroll to bottom of page for link)- Fact sheet on 2023 QPP program, comparison table, FAQs, and overview.

- CY 2025 PFS Final Rule Summary (AMA) - included is an executive summary and additional analyzations, made by AMA, of select provisions finalized in the rule.

- QPP Timeline and Important Deadlines (select the appropriate year)

- QPP Resource Library - fact sheets, quick guides, video libraries, etc.

- Physicians Advocacy Institute QPP Resource Center - provides additional information on navigating the QPP, MIPS pathway, video library, FAQs, QPP updates

- TMA QPP Resource Center - webinars, contacts, services, news, advocacy, timeline, important deadlines