What is an Alternative Payment Model?

An Alternative Payment Model (APM) is a payment approach that rewards providers for delivering high-quality and cost-efficient care. APMs require healthcare organizations (often a hospital and affiliated physician practices) to align themselves with the goal of taking better care of a population of patients, often defined by a geographic region. These payment models can apply to health care populations, episodes of care, or specific clinical conditions. APMs include bundled payments models, Accountable Care Organizations (ACOs), and Patient-Centered

Medical Homes (PCMHs), and others. APMs that do not qualify as Advanced APMs are required to participate in the Merit-based Incentive Payment System (MIPS).A common example of an APM is a Medicare Shared Savings Plan (MSSP) also known as an Accountable Care Organization (ACO).

What is an Advanced Alternative Payment Model?

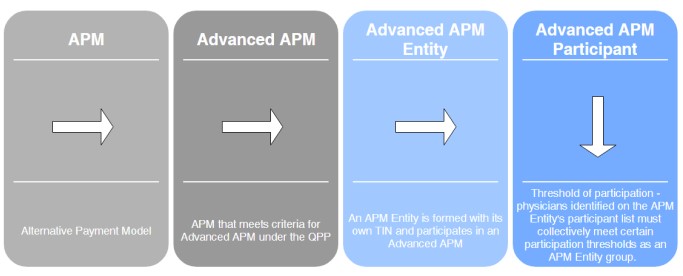

Advanced APMs (select current year) are entities that are formed to participate in an Advanced APM with CMS through a direct agreement. Physicians would participate in an Advanced APM by forming an APM Entity. Each APM Entity has its own TIN for participating in a specific Advanced APM. These Advanced APMs are a subset of APMs that allow practices to earn more rewards in exchange for taking on risk related to patient outcomes. Advanced APMs are also one of two payment paths under the Quality Payment Program (QPP) that will be used to determine Medicare Part B payment adjustments. In the Advanced APM track of the QPP, physicians may be exempt from participation in the Merit-based Incentive Payment System (MIPS) and be eligible to receive other incentives. Advanced APM criteria, financial incentives, and other information can be found on the CMS Advanced APMs website.

What is a MIPS Alternative Payment Model?

If you’re in a specific type of APM called a MIPS APM (select current year) and you are NOT excluded from MIPS (only Advanced APMs are excluded from MIPS), you may be scored using a special APM scoring standard. The APM scoring standard is designed to account for activities already required by the APM. For example, the APM scoring standard eliminates the need for MIPS clinicians to duplicate submission of Quality and Improvement Activity performance category data and allows them to focus instead on the goals of the APM.

Most Advanced APMs are also MIPS APMs so that if an eligible clinician participating in the Advanced APM does not meet the threshold for payments or patients through an Advanced APM in order to become a Qualifying APM Participant (QP), thereby being excluded from MIPS, the MIPS eligible clinician will be scored under MIPS according to the APM scoring standard. More information can be found on the Alternative Payment Model (APM) Performance Pathway (APP) website.

What is an All-Payer Advanced Alternative Payment Model?

Eligible clinicians are now able to become Qualifying Alternative Payment Model Participant (QPs) through the

All-Payer Option (select current year). This Option is attainable through participation in a combination of Advanced APMs with Medicare and Other Payer Advanced APMs. A clinician must be in a Medicare Advanced APM. A clinician can also combine their participation with an Other-Payer Advanced APM. Other-Payer Advanced APMs are non-Medicare Fee For Service (FFS) payment arrangements with other payers including:

- Medicaid;

- Medicare Health Plans (including Medicare Advantage, Medicare-Medicaid Plans, 1876 Cost Plans, and Programs of All Inclusive Care for the Elderly (PACE) plans);

- Payers with payment arrangements in CMS Multi-Payer 4 Models; and

- Other commercial and private payer arrangements that meet the criteria to be an Other-Payer Advanced APM.

Qualified Participation in an Advanced APM

Physicians and practitioners who participate in an Advanced APM are referred to as Qualified Participants (QP) or Partial Qualifying Participants (PQ), and may be excluded from MIPS reporting and payment adjustments for the applicable performance year/payment year. For payment years 2026 and beyond, payments made to QPs under the fee schedule will be updated annually by a 0.75% qualifying APM conversion factor. QPs can also receive a 1.88% APM Incentive Payment. Payments to non-QPs will be updated annually by a 0.25% qualifying APM conversion factor.

Participation in an Advanced APM is determined at the APM Entity level meaning all physicians and other eligible clinicians identified on the APM Entity’s Participant List must collectively meet the QP/PQ thresholds as an APM Entity group for each individual physician to receive credit for participation in an Advanced APM. CMS uses two methods to arrive at a QP or PQ determination - the Medicare Payment Count Method or the Medicare Patient Count Method:

QP: Eligible clinicians must receive at least 75% of Medicare Part B payments or see at least 50% of Medicare patients through an Advanced APM Entity during the QP performance period (January 1 - August 31).

PQ: Eligible clinicians must receive at least 50% of Medicare Part B payments or see at least 35% of Medicare patients through an Advanced APM Entity during the QP performance period (January 1 - August 31).

Clinicians can use the QPP Participation Status Tool to check their QP status and determine if they may be excluded from MIPS. The tool also includes participant data for Advanced APMs and MIPS APMs. Log in to your QPP account to view details.

Types of Advanced Alternative Payments Models

For proposed, current, and no longer active models, search the CMS Innovation Models web page. Use the search and search options function to locate specific models and locations.

How to Join an APM

- Locate specific APMs in your area and find one that fits your practice or review the comprehensive list of APMs.

- Contact the APM and inquire if they are accepting new applicants and obtain information about the application process.

Additional Resources