Recoupments, Refund Requests, and Managing Overpayments

Physicians must establish clear and consistent procedures to identify and process overpayments in their practice. If not properly managed, overpayments can result in substantial fines, criminal prosecution, and disciplinary action by the Texas Medical Board.

Commercial Payers

A failure to return credit balances to a commercial insurer in a timely manner may constitute a breach of contract and recoupment of the overpayment and may also be considered "conversion of property". Commercial payer agreements typically include provisions about how overpayments should be handled. Physicians should consult their contracts to ensure compliance with any specific procedures or timelines for returning overpayments to avoid legal or financial penalties.

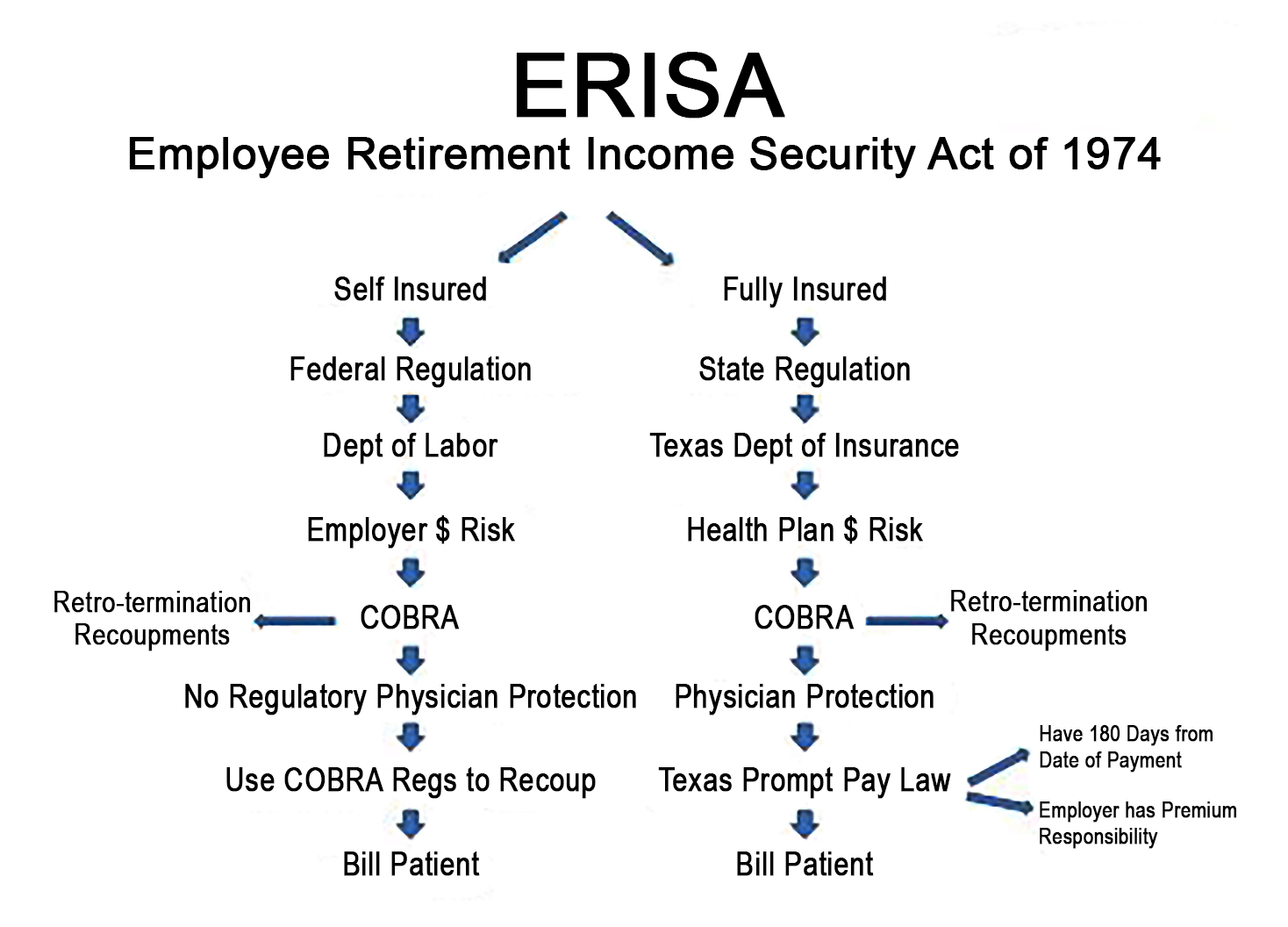

Fully-insured Health Plans:

The insurance company pays claims and assumes all risk. Fully insured plans are governed by the Texas Department of Insurance and must follow the Texas Prompt Pay Law (all fully insured plans have a TDI or DOI on the insurance card). In general, the Texas prompt pay law applies to fully insured HMO and PPO plans licensed and sold in Texas. It does not apply to other plans, i.e., Medicare, Medicaid, workers' compensation, TriCare, self-funded employer plans, state and federal employee plans, indemnity policies, and out-of-state Blue Cross plans (BlueCard) filed to Blue Cross and Blue Shield of Texas.

Refunds/Recoupments 180-Day Limit - This applies only to claims subject to the Texas prompt pay law. If 180 days have lapsed from the date payment was received, no refund is due. Carriers must first send a written refund request before automatically recouping money. After 45 days, if the carrier does not receive the refund or a written appeal, it can recoup the payment.

Verification - Verification, as defined in the Texas prompt pay law, is the ONLY guarantee that a payer cannot recoup later. "Pre-authorization" or simply "verifying benefits" is not a guarantee.

Self-insured Health Plans:

The employer pays claims and assumes all risk. These plans are regulated by ERISA and the Summary Plan Description for the plan.

Recoupment time limits are based on individual contractual agreements and/or the Summary Plan Description. Nothing prevents carriers from automatically recouping payments, regardless of the providers participation status with the plan. If the payer contract does not address recoupments then the Civil Practice and Remedies Code §16.004 applies and the statute of limitations is four years (excluding government programs). Refer to the Summary Plan Description for guidance.

A refund request/recoupment is considered an adverse benefit determination and as such, per CFR Title 29 2560.503-1(h), the plan must provide a reasonable opportunity to appeal.

Government Plans

Medicare (traditional):

In general, there is no practical time limit after which Medicare cannot ask for money back if fraud is suspected. However, in general, the

Recovery Audit Contractor (RAC) may not attempt to identify any overpayment or underpayment more than three years past the date of the initial determination made on the claim. The initial determination date is defined as the claim paid date. More information can be found in this

MLN guide.

On November 1, 2024, the CMS revised the “

60-Day Refund Rule,” which impacts physicians' obligations regarding Medicare and Medicaid overpayments. The rule requires that overpayments be reported and returned within 60 days of identification. However, physicians can suspend this 60-day deadline under certain conditions.

The new rule, effective January 1, 2025, allows for an extended period if an overpayment has been “identified” (defined using the False Claims Act definition of “knowingly”) and the physician conducts a “timely, good-faith investigation” to determine the existence and amount of overpayments. The 60-day clock for reporting and returning overpayments will be suspended until:

• The date that the investigation of related overpayments has concluded, and the aggregate amount of the initially identified overpayments and related overpayments is calculated; or

• The date that is 180 days after the date on which the initial overpayment was identified.

If no investigation is undertaken, the overpayment must be returned within 60 days. Failing to comply with these regulations could lead to substantial civil penalties—up to $24,947 per overpayment. Furthermore, violations of the

False Claims Act could result in additional penalties.

Medicare Advantage Plans (MAPs):

Per 42 CFR §405.980, Medicare Advantage plans typically have 1–5 years to recoup overpayments, depending on the reason, with federal rules generally allowing 1 year for any reason and up to 4–5 years for "good cause" (e.g., new evidence). Providers have 60 days to report/return identified overpayments.

Medicaid/Medicaid MCOs:

In general, Medicaid and MCOs may request refunds for up to five years. Depending on the circumstances (fraud is suspected), this time frame can be exceeded. Review MCO contracts for refund request and recoupment provisions that may differ from the 5 year rule. The “60-Day Refund Rule” applies to traditional Medicaid (when TMHP is the payer).

State and federal employer plans:

In general, there is no time limit for refund requests or recoupments. Refer to the Summary Plan Description or the contract for guidance.

Patient/Beneficiary Refunds

Texas laws TIC Sec. 1661.005, TPC Title 6, Chs. 71-77, and TOC Sec. 101.352(h) require physicians to refund patient overpayments, regardless of the amount, within 30 days of determining an overpayment has been made. Failure to do so may result in penalties and interest from the Texas Comptroller of Public Accounts, possible criminal charges relating to conversion of property, and disciplinary action from the Texas Medical Board. If the patient or beneficiary cannot be located, Texas law mandates that the overpayment must be submitted to the Office of the Texas Comptroller's unclaimed property unit. A written notice must also be sent to the beneficiary’s last known address, if available. Records of unclaimed funds must be retained for 10 years from the date reported them to the Comptroller.