Guide to the Federal No Surprises Act

Disclaimer

Please note the content provided herein is informational only, and should NOT, in any way, be considered legal, professional, business, practice, or other advice. Consult your own practice adviser or attorney before taking any action or inaction based on this information.

The federal No Surprises Act (NSA) took effect Jan. 1, 2022 and establishes new regulations to protect patients against surprise medical bills/balance billing. These regulations establish, among other things, rules for out-of-network (OON) services in certain situations, good faith estimates (GFE) for self-pay patients, and an independent dispute resolution (IDR) process. Federal agencies published two interim final rules part 1 and part 2 and another proposed rule to implement the law. The two major components of the act are the federal regulation of certain surprise medical bills, and provider price transparency requirements. This CMS No Surprises Act Toolkit for Consumer Advocates provides resources and information to better understand the Act.

Provider Price Transparency

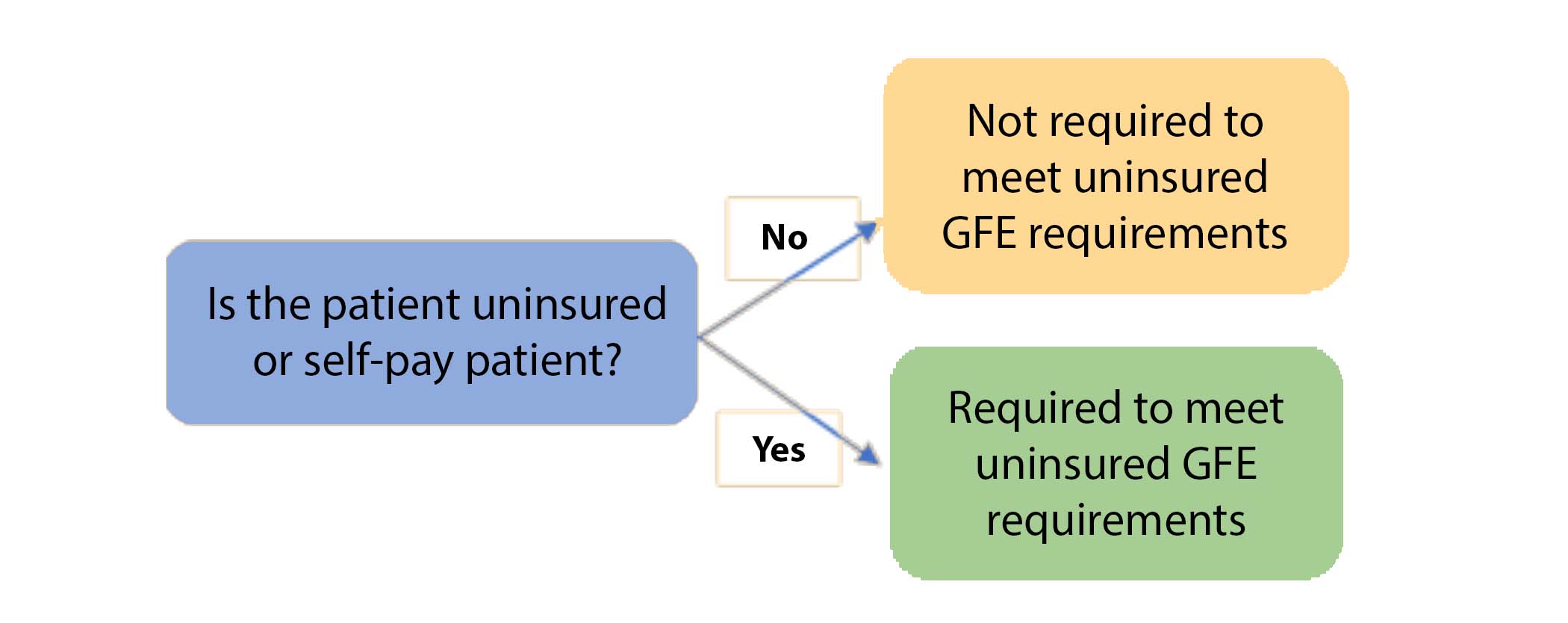

Applicability:

These price transparency rules apply to self-pay patients – patients who are uninsured, or patients who are insured but do not want a claim sent to their health plan. Patients with short-term insurance are also considered uninsured. Providers are required to inquire if a patient will be self-pay.

Self-Pay Services:

“Convening providers," physicians and facilities that receive an initial request for a good faith estimate (GFE) or that are responsible for scheduling the primary service, must provide self-pay patients with a GFE of the anticipated total cost of care. The GFE must reflect the cash price for a “period of care” which is defined as the day or multiple days in which the primary service is performed including any additional services that will likely be furnished in conjunction with the primary service. This includes the cost of services from other “co-providers” rendering services in the period of care (note: HHS will not enforce this provision pending future rulemaking).

Required Notice and Consent:

Providers are required to provide notice of the GFE requirements on their website, in the office, and on-site where scheduling or questions about the cost of health care items or services occur. The GFE must be an itemized listing of each item or service grouped by each provider or facility offering care, be clear and understandable, and provided in paper or electronic format. CMS provides templates for both the notice and the estimate.

GFE Timeframes:

- If a self-pay patient schedules care at least 10 business days in advance, the provider has 3 business days to

issue the GFE;

- If a self-pay patient schedules care at least 3 business days in advance, the provider has 1 business day to

issue the GFE;

- If a self-pay patient schedules care less than 3 business days out, then the provider is not required to issue a

GFE.

- If a self-pay patient requests a GFE prior to scheduling, the GFE must be provided within 3 business days;

and again once the service is scheduled.

- If the estimated cost of services changes, the GFE must be updated at least 1 business day before the service

is rendered.

Surprise Medical Bills

Applicability:

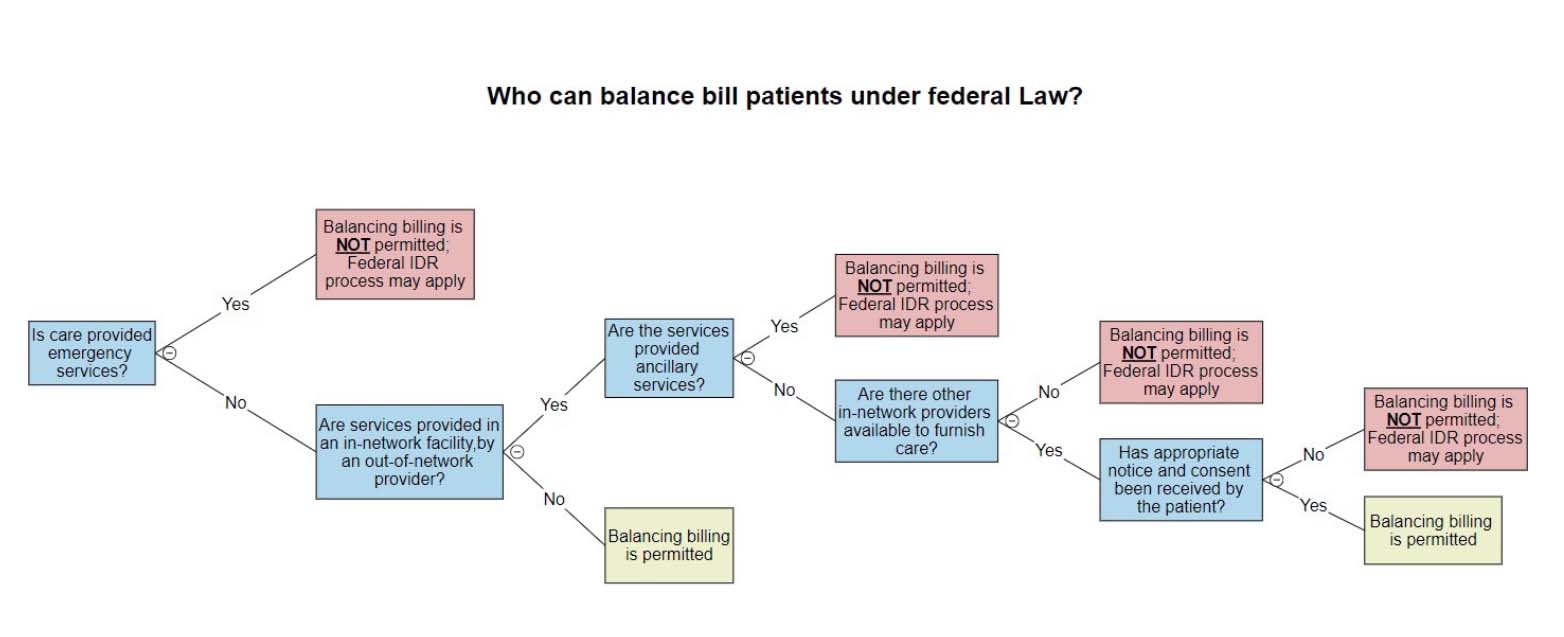

These protections will apply to surprise bills for specific types of services provided in certain settings (see bullets below).

The protections generally only apply in the facility setting and not to care furnished in a physician’s office. All Out of Network (OON) providers at in-network facilities are banned from balance billing unless they are of the type, and in such circumstances, where they can obtain consent from the patient to do so. Emergency care and ancillary provider services may never be balance billed. The NSA applies generally to self-funded plans regulated by

ERISA; it

does not apply to government health programs like traditional Medicare and Medicaid, and managed Medicare and Medicaid, as they already have patient protections.

OON Services:

The NSA provides protections requiring health plans to cover Out of Network (OON) claims at in-network cost sharing rates for certain services. Protections will apply to most surprise bills for specific types of services provided in certain settings. It also prohibits certain OON physicians, hospitals, and other covered providers from billing patients more than their in-network cost sharing amount unless the provider is of a type to be eligible to receive notice and consent exemptions from patients that would allow balance billing more than the in-network rate.

- Emergency Services – Balance billing is never allowed for most emergency services which includes those provided in hospital emergency rooms, freestanding emergency departments, and urgent care centers that are licensed to provide emergency care; air ambulance transportation (emergency and non-emergency), but not ground ambulance; emergency care including screening and stabilizing treatment sought by patients who believe they are experiencing a medical emergency or active labor; pre-stabilization services that are provided after the patient is moved out of the emergency department.

- Post-emergency stabilization services – Balance billing is never allowed for post-stabilization services provided in a hospital following an emergency visit. Post-stabilization care is considered emergency care until a physician determines the patient can travel safely to another in-network facility using non-medical transport, that such a facility is available and will accept the transfer, and that the transfer will not cause the patient other unreasonable burdens. Patients must receive written notice and give written consent to be transferred.

- Non-emergency services provided at in-network facilities – Balance billing may be allowed if proper notice and consent is obtained. These services include non-emergency services provided by OON providers at in-network hospitals and other facilities. Non-emergency services include treatment, telemedicine services, equipment and devices, imaging, lab, and preoperative and postoperative services, regardless of whether those services are provided within the facility itself. The NSA defines a facility to include hospitals and their outpatient departments, and ambulatory surgery centers (ASC) (nursing homes, hospice, birthing centers, etc. are not defined as facilities).

Required Notice and Consent:

Providers and facilities must publicly post a notice summarizing the NSA surprise billing protections on their public website and within the facility and give this disclosure to each patient for whom they provide NSA-covered services. This disclosure must be one page (can be double sided) and must include any balance billing protections and contact information for the appropriate state and federal agencies overseeing the balance billing protections. Refer to the notice for delivery time frames and other requirements. CMS provides templates for both the

prior written consent form and the

standard notice.

An exception to balance billing is allowed if patients give prior written consent (see above link) to waive their rights under the NSA and be billed by non-ancillary OON providers. Providers are never allowed to ask patients to waive their rights for emergency services or for certain other non-emergency services or situations. The waiver should be obtained only in limited circumstances where the patient knowingly and purposefully seeks care from an OON provider and not to circumvent the law’s consumer protections. Consent must be given voluntarily, and physicians can refuse care if consent is denied. The waiver is not permitted for:

- Emergency services

- Items and services provided by an OON provider if there is not another in-network provider who can provide that service in that facility

- Unforeseen urgent medical needs that come about when non-emergent care is furnished

- Ancillary services including items and services related to emergency medicine, anesthesiology, pathology, radiology, and neonatology

- Items and services provided by assistant surgeons, hospitalists, and intensivists

- Diagnostic services including radiology and lab services

Payment Dispute Resolution

Independent Dispute Resolution:

The NSA establishes an Independent Dispute Resolution (IDR) process when physicians disagree with the payors payment rate. Physicians have 30 days after payment is received to negotiate with the payor. If an agreement cannot be reached, the physician must notify the payor and HHS that they are initiating an IDR process. Within three days following the date the IDR process is initiated, the provider and plan must jointly select a certified IDR entity. The parties must submit final offers, information requested by the IDR entity, and other information that is relevant to their offers within 10-days of selecting the IDR entity. It is further advised that this 4 page

letter be sent to the IDR entity/arbiter informing of the vacated rules to insure the case is evaluated on the appropriate parameters (click on your IDR entity for a prepopulated letter). Negotiations between the parties may continue during this time. The party whose offer is rejected must pay the IDR costs. If you participated in an open negotiation period that has expired without an agreement for an out-of-network total payment amount for the qualified IDR item or service you can initiate an IDR process on the

CMS portal. See the

CMS OON IDR Guide and the

AMA IDR Toolkit for additional information.

Self-Pay Patient Dispute Resolution:

The NSA allows self-pay patients to initiate a dispute with HHS when the total billed charges are $400 greater than the list of line items and services provided in the initial good faith estimate (GFE). Once a provider is notified of the dispute, the provider has 10 business days to provide a copy of the disputed GFE, bill, and any other documentation showing the fee difference was based on a medically necessary item or service that could not have been reasonably anticipated when the GFE was provided. All billing and collections, accrual of late fees, etc. must cease at this time. The parties may reach a settlement prior to resolution of the dispute, and the provider must notify the dispute resolution entity of such within 3 business days of the settlement.

Provider Directory Requirements

The No Surprises Act provider directory provisions require health plans and practices to put processes in place to improve the quality and accuracy of provider directory data. The Act stipulates that health plans and providers verify all provider directory data every 90 days, process updates within two business days of receiving updated information, and remove providers from the directory if their information has not been verified during a period specified by the health plan. Additionally, if a health plan verifies to a patient online or by phone that a provider is in-network when they are not, the plan cannot impose out-of-network cost sharing and must apply the in-network cost share to the patient. One streamlined way for physicians to comply with this provision and establish the required process in the Act is to utilize CAQH (Council for Affordable Quality Healthcare) and update/confirm their data quarterly. Health plans can then access the practice's CAQH profile to obtain the needed confirmation of the accuracy of their directory data. Additionally, providers and health care facilities must submit provider directory information to a plan or issuer:

• When the provider or health care facility begins a network agreement with a plan or issuer with respect to certain coverage;

• When the provider or health care facility terminates a network agreement with a plan or issuer with respect to certain coverage;

• When there are material changes to the content of provider directory information of the provider or health care facility;

• At any other time determined appropriate by the plan, provider, health care facility, or the Secretary of Health and Human Services (HHS);

• Upon request by the plan or issuer.

State vs. Federal Surprise Billing Laws

The NSA is meant to supplement state laws, not replace them, and creates a floor for balance billing protections. In general, Texas surprise billing laws apply to fully insured plans only. The federal law applies to self-insured plans regulated under ERISA that have not voluntarily opted-in to Texas law. Texas law preempts federal law in two areas:

1. In determining the OON payment rate and dispute resolution process, and

2. How the recognized amount is calculated to determine patient cost sharing amounts

Further, Texas law preempts federal law when the Texas law is more restrictive. More detailed information on this topic can be found on the Texas Department of Insurance balance billing web page, and the TMA summary of the SB 1264.

Additional Resources:

NSA FAQs

TMA white paper

TMA resources

AMA Toolkit – Preparing for Implementation of the No Surprises Act

CMS Provider Resources

CMS GFE FAQs

CMS Tips for Disputing Parties

Texas approach to the No Surprises Act (Powerpoint)

TDI Texas balance billing physician resources

No Surprises Act Protections: Status of Implementation